Compute payroll taxes

Sign up make payroll a breeze. Taxes Paid Filed - 100 Guarantee.

Enerpize The Ultimate Cheat Sheet On Payroll

Make Your Payroll Effortless So You Can Save Time Money.

. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Get Help From the Best IRS Tax Debt Companies Pay Less to the IRS.

For the 2020 tax year employers and employees both pay 62 of the employees wages toward Social Security the total contributions must equal 124. Payroll FICA and FUTA taxes are calculated from an employees gross taxable wages. Free Unbiased Reviews Top Picks.

Some states follow the federal tax. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Discover ADP Payroll Benefits Insurance Time Talent HR More. The first step to calculate payroll taxes is calculating the wages earned by each employee and the amount of taxes that need to be withheld as part. Ad 4 out of 5 customers reduce payroll errors after switching to Gusto.

Due to the fact that these tax codes are. Compare Sonarys Most Recommended Payroll Find The Perfect Match For Your Business. Ad Easy To Run Payroll Get Set Up Running in Minutes.

Well Do The Work For You. Ad Compare This Years Top 5 Free Payroll Software. Gross taxable wages include the cumulative salaries wages.

The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Use this tool to.

This number is the gross pay per pay period. When you start a new job or get a raise youll agree to either an hourly wage or an annual salary. Get Started With ADP Payroll.

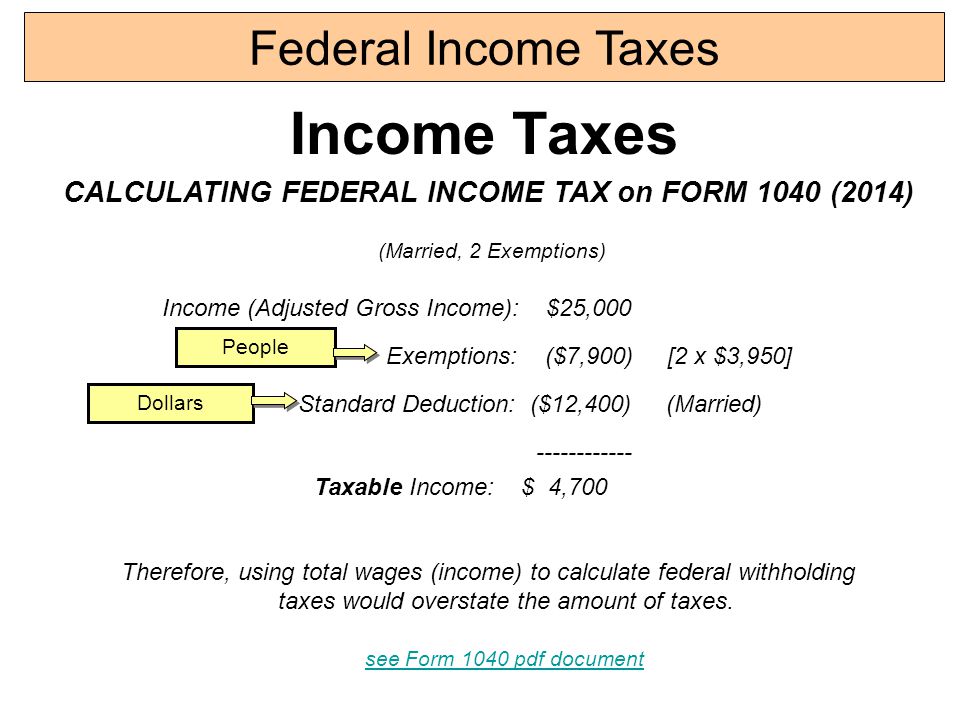

Subtract 12900 for Married otherwise. Ad Owe Taxes to the IRS. Calculating Payroll Taxes.

The Best IRS Tax Relief Companies - Checked Reviewed Ranked For All Your Needs. Simply the best payroll software for small business. The next step is calculating how much you will need to pay in payroll taxes.

How Your Paycheck Works. Get Started for Free. Ad Compare Side-by-Side the Best Payroll Service for Your Business.

Ad Get It Right The First time With Sonary Intelligent Software Recommendations. Focus on Your Business. For example if an employee earns 1500.

Estimate your federal income tax withholding. Ad Process Payroll Faster Easier With ADP Payroll. Household Payroll And Nanny Taxes Done Easy.

Ad CareCom Homepay Can Handle Your Household Payroll And Nanny Tax Obligations. 2020 Federal income tax withholding calculation. But calculating your weekly take-home.

Subtract any deductions and. Ad Process Payroll Faster Easier With ADP Payroll. Calculating payroll taxes is tricky because business owners need to account for federal state and local taxes when preparing employee paychecks.

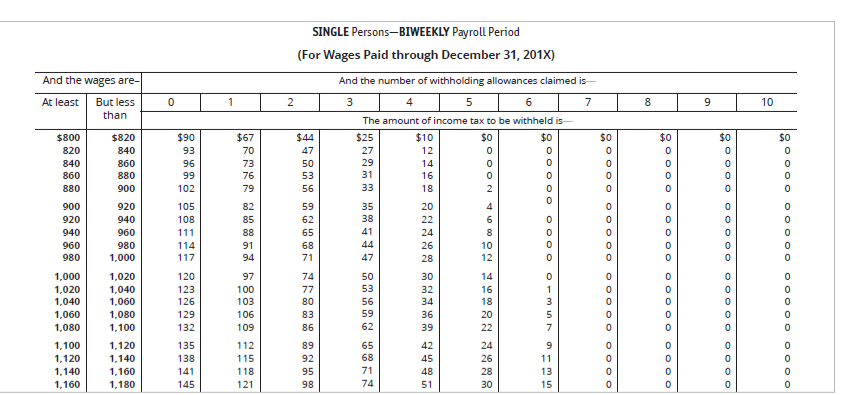

This is generally done by completing the following steps. How to calculate annual income. Federal income tax withholding Social Security and Medicare FICA unemployment workers compensation and state or local.

See how your refund take-home pay or tax due are affected by withholding amount. There are several categories of payroll taxes. It will confirm the deductions you include on your.

The state tax year is also 12 months but it differs from state to state. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Get Started With ADP Payroll.

Excel Formula Income Tax Bracket Calculation Exceljet

How To Calculate Federal Withholding Tax Youtube

Federal Income Tax Fit Percent Method How To Calculate Fit Using Percent Method Youtube

Payroll Tax What It Is How To Calculate It Bench Accounting

How To Calculate Payroll Taxes Methods Examples More

How To Calculate Payroll Taxes In 5 Steps

Solved 1 Compute Werner S Gross Pay Payroll Deductions Chegg Com

How To Calculate Income Tax In Excel

How To Calculate 2019 Federal Income Withhold Manually

Federal Income Tax Fit Payroll Tax Calculation Youtube

Solved W2 Box 1 Not Calculating Correctly

Solved 1 Compute Werner S Gross Pay Payroll Deductions Chegg Com

Calculating Federal Income Tax On Form 1040 2014 Ppt Video Online Download

Social Security Tax Calculation Payroll Tax Withholdings Youtube

How To Compute Withholding Tax Based On The Newly Enacted Train Law Tax Reform For Acceleration And Inclusion Sprout Solutions

Solved Compute The Net Pay For Each Employee Using The Chegg Com

How Payrollhero Computes The Philippine Bir Tax Deduction Payrollhero Support